Alphabet shares soar after Q1 results. Is it too late to buy? | Colorful fool

Artificial intelligence helped drive Alphabet’s Q1 results.

Actions from Alphabet (GOOG -3.33%) (GOOGL -3.37%) it soared to new highs after its first-quarter earnings report. This is a continuation of the momentum the stock has seen over the past year, with its shares up more than 60% in that period.

Here’s a look at why Alphabet stock rallied after its Q1 earnings report, and more importantly, whether or not it’s too late to buy the stock after its strong earnings.

Alphabet as an AI company

At earnings calls, Alphabet executives proudly announced that the company has been the first artificial intelligence (AI) company since 2016. Investors worry that AI could be more detrimental to Alphabet and its search dominance. What the company is doing to shift that sentiment and show that AI is helping to drive growth is a big positive.

Artificial intelligence is driving the results of Google Cloud, whose first-quarter revenue rose 28% to $9.6 billion. The cloud business is also starting to show some solid operating leverage as it scales, leading to a 3.7x increase in segment operating income to $900 million. This business has high fixed costs, so as it grows and absorbs those fixed costs, profitability will grow much faster than revenue growth.

Alphabet touted its AI hypercomputer, which can train and operate models in an efficient and cost-effective manner, as a big differentiator. The company said that its Google Cloud services are used by 60% of funded start-ups gen AI and almost 90% gen AI unicorns.

However, this is not the only area where society benefits from AI. Alphabet uses it in its advertising ecosystem to help with everything from targeting, bidding, creative and measurement. For example, it developed a smart bidding tool that uses artificial intelligence to predict future ad conversions.

It is also used with search, where AI insights help improve the search experience while prioritizing traffic to merchant websites. The company added that it is seeing increased search usage from people using the new feature.

The benefits of AI enhancements, along with a solid advertising background, have led to solid growth in search and YouTube as well. Search revenue rose 14% to $46.2 billion in the quarter, while YouTube ad revenue jumped 21% to $8.1 billion.

These are impressive results and certainly help advance the AI story for Alphabet. The company has been investing in artificial intelligence for quite some time now, and these investments are starting to pay off.

Image source: Getty Images.

Dividend and buybacks

In addition to the company’s solid results, investors were also excited by Alphabet’s new capital allocation plans. (Capital allocation is how companies manage their cash flow.)

Alphabet has announced that it will pay its first ever dividend. A dividend of $0.20 per share will be paid in June, and the company plans to pay a quarterly dividend. While Alphabet won’t be mistaken for a high-yield stock, I expect the company to keep raising its dividend for years to come.

At the same time, Alphabet announced a $70 billion share buyback program. It did not give a time frame for when it would buy back its shares, only saying it would be in the best interest of the company and its shareholders.

But Alphabet’s No. 1 priority remains investing in its business. They still see huge opportunities ahead.

Is it too late to buy stocks?

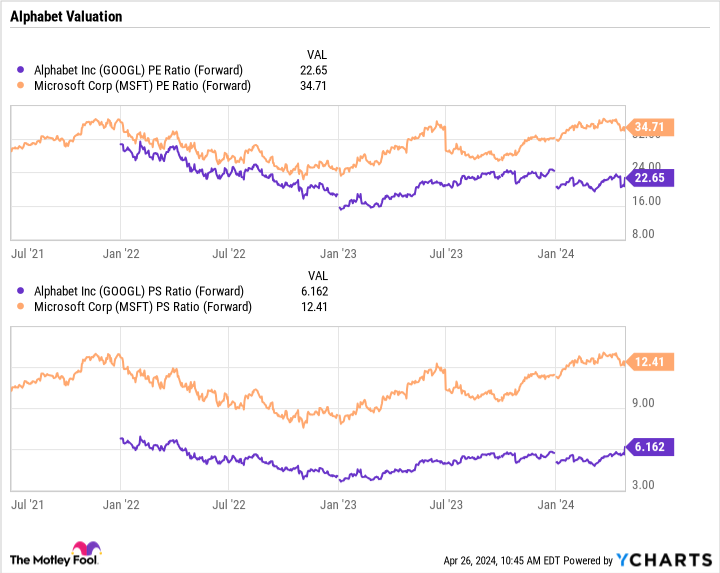

Despite the stock’s strong performance over the past year, Alphabet still trades at a very reasonable valuation, with a forward price-to-earnings (P/E) ratio of around 22.6x and a trailing 6x. This is a significant discount for the opponent Microsoftwhich also benefits from many of the same AI trends.

GOOGL PE Ratio (Forward) data by YCharts.

The company is clearly showing that AI is benefiting, and the opportunity ahead is huge. Given Alphabet’s valuation and growth potential, it’s not too late for investors to buy the stock, as the stock has great growth potential over the long term.

Suzanne Frey, CEO of Alphabet, is a board member of The Motley Fool. Geoffrey Seiler has positions in Alphabet. The Motley Fool has positions and recommends Alphabet and Microsoft. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.